Table of Contents

You’re sitting in a contract negotiation for a $500 million power plant project. The client wants to use the FIDIC Silver Book. Your boss leans over and whispers, “Is that the right one for this?” You freeze. Silver Book? Red Book? What’s the difference?

If you don’t know, you’re about to commit your company to the wrong risk allocation. Possibly millions in unexpected liability. This happens more than you’d think. FIDIC contracts are the global standard in construction and engineering. They’re used on billions of dollars of projects every year. Yet many professionals don’t truly understand them.

Let me fix that.

Overview of FIDIC Standard Contract Books: What They Are and Why They Exist

FIDIC stands for the International Federation of Consulting Engineers. Sounds bureaucratic. But these folks created something brilliant. They developed standard contract forms that everyone could use. No need to draft contracts from scratch every time. Just pick the right template. Customise where needed. Start building. The first FIDIC contract was the Red Book in 1957. It covered civil engineering works. Over decades, FIDIC realised one size doesn’t fit all. Different projects need different risk allocations.

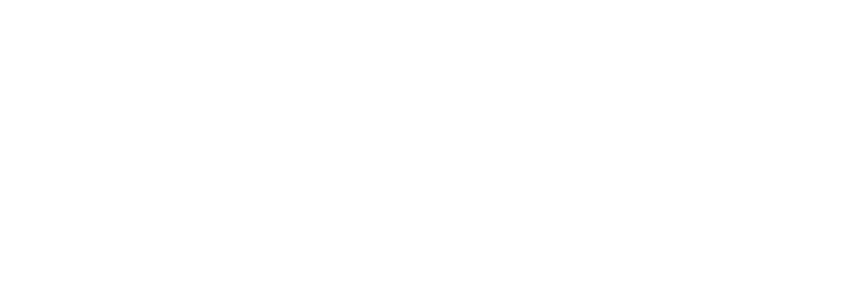

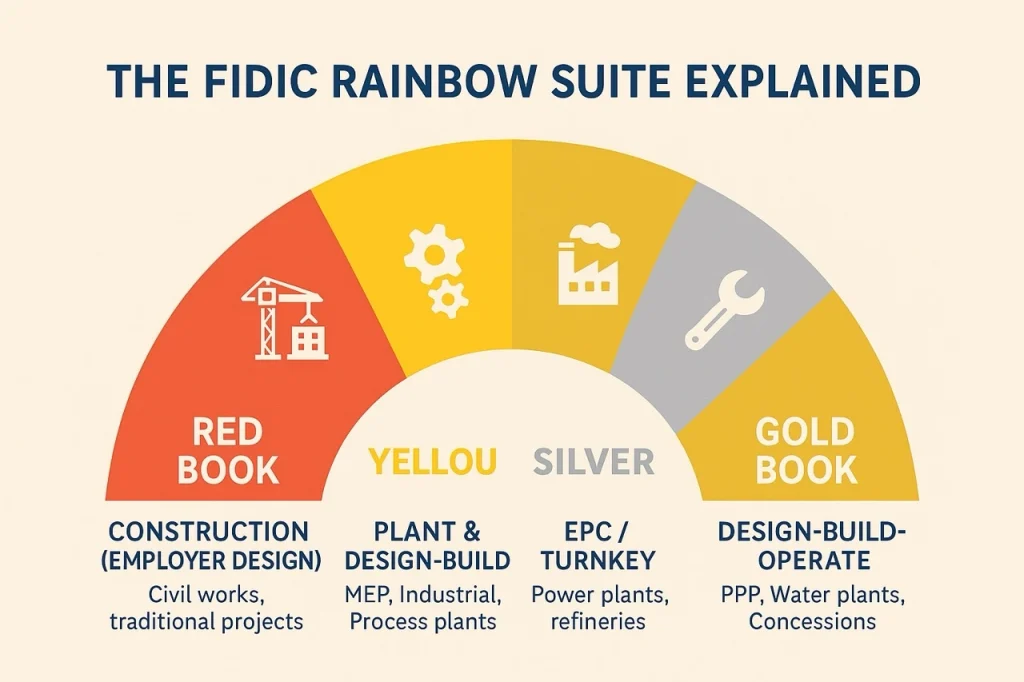

So they created a “Rainbow Suite” of contracts. Each book uses a different colour. Each serves a different purpose. The main ones you’ll encounter are the Red Book, Yellow Book, Silver Book, and Gold Book. There are others. But these four dominate international construction. Why does this matter? Because choosing the wrong contract book is like using the wrong tool. Try hammering a nail with a screwdriver. It doesn’t work well.

Each FIDIC book allocates risk differently. Who designs? Who takes ground condition risk? Who controls costs? Who manages the schedule? These aren’t small details. They determine whether a project succeeds or becomes a legal nightmare. International funding agencies, such as the World Bank, often require FIDIC contracts. Many governments mandate them. If you work on large infrastructure or EPC projects, you can’t avoid FIDIC. The question isn’t whether you’ll use FIDIC. It’s whether you’ll use it correctly.

Understanding Each FIDIC Book: Red, Yellow, Silver & Gold

Let’s break down each book. What it’s for. When to use it. Who bears what risk?

Red Book: Employer-Designed Construction Works

The Red Book is where it all started. It’s designed for traditional construction projects. Here’s the setup. The employer designs the project. They hire engineers or architects. They create detailed drawings and specifications. Then they hire a contractor to build according to those designs.

Think bridges. Roads. Dams. Buildings where the employer knows exactly what they want. Payment usually works through a Bill of Quantities. The contractor measures work done. Quantities are remeasured during construction. Payment follows actual quantities, not just estimates.

Risk allocation is relatively balanced. The employer designed it, so they take design risk. If the design has problems, that’s on them. The contractor takes the construction risk. If they build poorly or inefficiently, that’s on them.

Ground conditions are particularly important. The Red Book typically makes the employer responsible for unforeseeable ground conditions. The contractor gets site data. If actual conditions differ materially from what the data indicated, the contractor can claim extra cost and time. This makes sense. The employer controls the site investigation. They should bear the risk if their information is wrong.

The Engineer plays a crucial role. Not the contractor’s engineer. An independent engineer appointed by the employer, but with duties to act fairly. They certify payments. They make determinations on claims. They approve designs and variations. This creates a semi-independent administration structure.

Yellow Book: Plant and Design-Build Contracts

The Yellow Book shifts design responsibility to the contractor.

Now the employer says, “I want a wastewater treatment plant with these performance requirements.” The contractor designs it, builds it, and makes it work. This suits mechanical and electrical works. Water treatment plants. Industrial facilities. Buildings where the contractor has specialised design expertise.

Payment is usually a lump sum or based on milestones. The contractor quoted a fixed price for delivering a finished, working facility. Remeasurement is less common because the employer doesn’t control the design details.

Design risk shifts dramatically. The contractor designed it. If the design doesn’t work, the contractor fixes it at their cost. If the design doesn’t meet performance requirements, the contractor pays penalties.

But the employer still provides requirements. Performance specs. Site data. Constraints. If the employer’s requirements are defective or impossible, that’s the employer’s problem. The Engineer remains similar to the Red Book. Independent party. Certifies payments. Makes determinations. Provides some balance between parties.

The Yellow Book works well when you want design innovation. When the contractor’s expertise adds value. When you want single-point responsibility for design and construction.

I once worked on a Yellow Book project where the contractor found a more efficient design during construction. They saved cost and schedule. Under a Red Book, that innovation would have required formal variations and negotiation. Under the Yellow Book, the contractor just implemented improvements.

Silver Book: EPC and Turnkey Projects

The Silver Book is where contractors take almost all the risk.

It’s designed for complete turnkey projects. Engineering, Procurement, Construction. The whole package. Think power plants. Refineries. Major industrial facilities.

The contractor designs, procures all equipment, builds, tests, commissions, and guarantees performance. The employer gets a working facility. Period.

Risk allocation is heavily one-sided. The contractor takes:

- Design risk

- Construction risk

- Cost risk (usually a lump sum)

- Schedule risk

- Performance risk

- Often, even the ground condition risk

The employer basically says, “Build me this. Guarantee it works. Here’s the price. Don’t come crying if it costs more.”

The contract administration is different, too. There’s no independent Engineer. Instead, there’s an Employer’s Representative. This person works directly for the employer. They’re not supposed to be impartial.

Why would contractors accept this? Because the price reflects the risk. Silver Book projects typically cost more than Yellow Book equivalents. The contractor prices in contingency for all those risks.

The Silver Book suits projects where:

- The employer wants certainty. Fixed price. Fixed completion date. Guaranteed performance.

- The project is well-defined and stable

- The contractor has experience and can price risks accurately

- Private sector projects where commercial terms dominate

But it’s dangerous when the scope is uncertain. When site conditions are unknown. When the employer frequently changes their mind.

I’ve seen Silver Book projects where the contractor took too much risk too cheaply. They went bankrupt mid-project. The employer saved money upfront but lost far more in delays and disputes.

Gold Book: Design-Build-Operate Contracts

The Gold Book is less common but important for certain projects.

It’s designed for projects where the contractor not only builds but also operates the facility for years.

Think public-private partnerships. The contractor designs and builds a toll road. Then operates it for 25 years. Or a water treatment plant where the contractor runs operations under a long-term contract.

This extends responsibilities far beyond construction. The contractor must think about operational efficiency. Maintenance costs. Long-term performance. Lifecycle considerations.

The contractor’s incentive aligns with good design and construction. If they built it poorly, they’ll pay through expensive operations and maintenance.

Gold Book projects are complex. They require sophisticated risk allocation. Performance regimes. Payment mechanisms over the decades. Handback conditions.

Most companies don’t encounter Gold Book projects regularly. But if you work in infrastructure PPPs, you need to understand it.

Who Bears Which Risk? — FIDIC Risk Allocation Matrix

| FIDIC Book | Design Risk | Cost Overrun Risk | Ground Condition Risk | Schedule Risk | Performance Risk |

|---|---|---|---|---|---|

|

🏗️

Red Book

Construction (Employer Design)

|

Employer ✗ | Shared 🔄 | Employer ✗ | Shared 🔄 | Shared 🔄 |

|

⚙️

Yellow Book

Plant & Design-Build

|

Contractor ✓ | Contractor ✓ | Shared 🔄 | Contractor ✓ | Contractor ✓ |

|

🏭

Silver Book

EPC / Turnkey

|

Contractor ✓ | Contractor ✓ | Contractor ✓ | Contractor ✓ | Contractor ✓ |

|

🔧

Gold Book

Design-Build-Operate

|

Contractor ✓ | Contractor ✓ | Shared 🔄 | Contractor ✓ | Contractor ✓ |

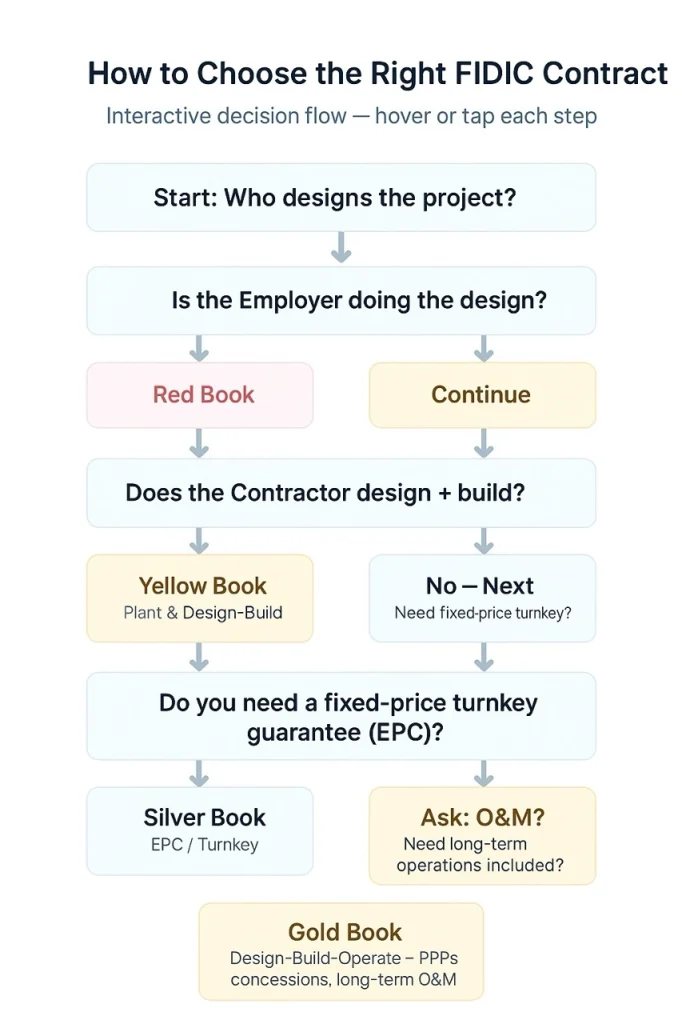

2017 vs 1999 Editions: What Changed and Why Training Matters

Here’s where things get tricky.

Many professionals learned FIDIC using the 1999 editions. Those contracts were industry standard for nearly 20 years. Then, in 2017, FIDIC released major updates.

Not just minor tweaks. Substantial changes.

The 2017 editions have more clauses. Renumbered clauses. New obligations. Different procedures.

Key changes include:

Health and safety obligations. The 2017 books explicitly address health and safety. The contractor has defined duties. The employer has duties too. This reflects modern expectations but creates new compliance requirements.

Liability caps. The 2017 contracts include provisions for limiting liability. Under the 1999 editions, liability was often unlimited unless specifically capped in Particular Conditions. Now there’s a structure for agreeing caps upfront.

Time bars. The rules for claims and notices got stricter. Miss a deadline? You might lose your right to claim. The 2017 editions clarified and tightened these time bars.

Early warning procedures. These were strengthened. Parties must actively warn about problems early. Failure to give early warning can reduce your claims.

Dispute avoidance. The dispute resolution process was restructured. Now there are clearer steps before jumping to arbitration.

Clarity on variations. The 2017 editions cleaned up variation procedures. Who can order variations? Time limits for responses. What happens if parties disagree?

For someone used to the 1999 Red Book, the 2017 version looks familiar but different. Clause numbers changed. Your muscle memory is wrong. You look for Clause 20.1 on claims, and it’s in a different place.

Worse, some obligations changed. You think you know the rules. But you’re applying outdated knowledge. That’s dangerous.

This is why training matters. You can’t just wing it based on old experience. The 2017 editions require deliberate learning.

Many projects still use the 1999 editions. Some employers haven’t updated. So you need to know both versions. Know what changed. Know which version your contract uses.

I’ve been in meetings where experienced people debated a clause. They were both right. But one was quoting the 1999 version and the other the 2017 version. Neither realised they weren’t talking about the same contract.

What a Good FIDIC Contracts Training Course Should Cover

Comprehensive FIDIC training isn’t about memorising clauses. It’s about understanding how the contracts work. How to use them. How to avoid traps.

Here’s what quality training should include:

Introduction to FIDIC and its purpose. Why FIDIC exists. Why standard forms matter. How FIDIC fits in the global construction market. Which projects use FIDIC and why?

Overview of each book. Red, Yellow, Silver, Gold. What they’re for. When to use each. How they differ in risk allocation and administration.

Clause-by-clause walkthroughs. At least for the major clauses. Not reading every word. But understanding key provisions. What do they mean? How they apply in practice.

The General Conditions are standard. But the Particular Conditions customise everything. Training should cover how these interact. What happens when they conflict?

Contract Data has become critical in the 2017 editions. This is where you fill in project specifics. Get it wrong, and your contract doesn’t work properly.

Comparison of the 1999 and 2017 editions. Side-by-side analysis. What changed. Why did it change? How to transition. Which projects still use 1999 and why?

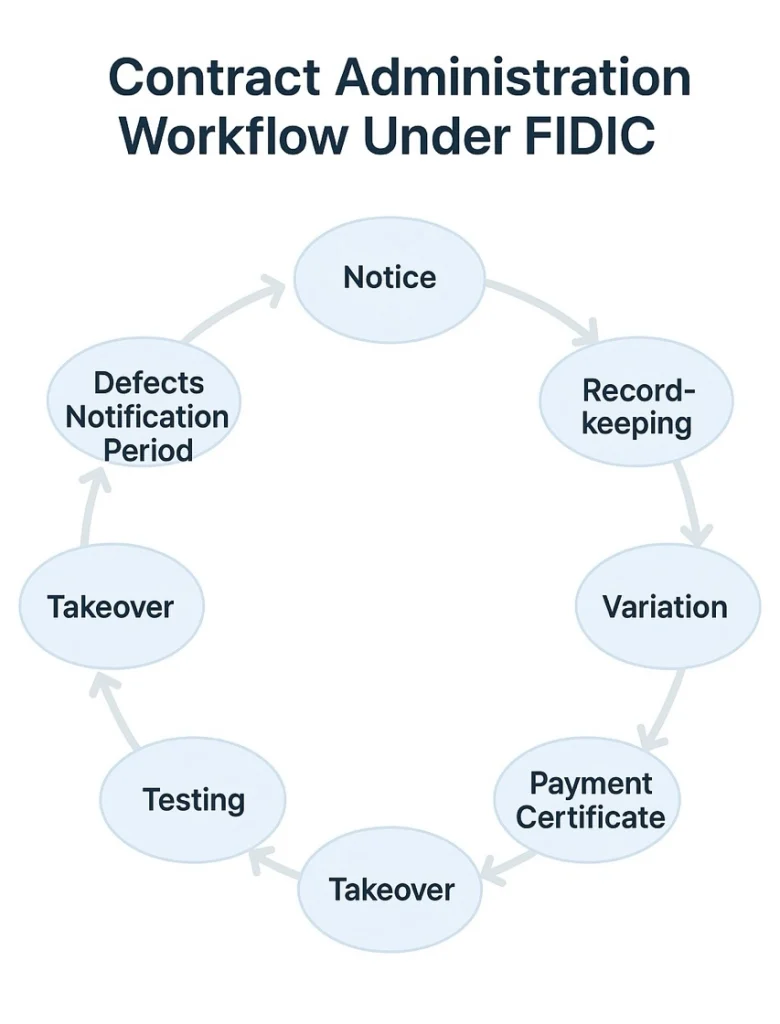

Contract administration procedures. How notices work. Communication requirements. Variation procedures. Payment processes. Completion and takeover. Defect liability.

These aren’t just paperwork. Miss a notice deadline and lose your claim. Use the wrong notice procedures and your variation isn’t valid.

EPC and turnkey specifics under Silver Book. The Silver Book has unique challenges. Training should cover how to manage full turnkey delivery. Performance testing. Guarantees. Employer’s Representative role. How to handle changes when there’s no independent Engineer.

Claims and dispute resolution. Understanding claims procedures. Time bars. Notice requirements. Supporting documentation. Extension of time claims. Cost claims.

Then dispute resolution. Early warnings. Employer’s determinations. Dispute Avoidance and Adjudication Board procedures. When and how to escalate.

Real-world case studies. Theory only goes so far. Good training uses actual project examples. Disputes that happened. How could they have been avoided? Lessons learned.

Mock exercises help too. Draft a variation order. Prepare a claim. Respond to a notice. These practical exercises reveal gaps in understanding.

Tools and best practices. Many organisations use templates. Checklists. Flowcharts for procedures. Training should provide these tools.

Some courses introduce contract management software. Document control systems. How to maintain proper records and audit trails.

Technical and contractual integration. Especially important for engineers. How technical decisions trigger contractual consequences. How design changes affect contract obligations. How testing and commissioning procedures relate to takeover and payment.

Who Should Take FIDIC Training and What Value It Adds

FIDIC training isn’t just for lawyers. Anyone touching these contracts needs to understand.

Project managers run projects under FIDIC contracts. They need to understand obligations. Procedures. Risk allocation. When to involve commercial or legal teams.

Contract managers and administrators live in these documents daily. They process claims. Manage variations. Track compliance. They need deep, detailed knowledge.

Engineers and technical staff often think contracts are someone else’s problem. Wrong. Their technical decisions have contractual impacts. Design changes. Quality issues. Testing failures. All trigger contract clauses.

Commercial and procurement teams negotiate and finalise contracts. They need to understand what they’re agreeing to. How do different clauses affect their company’s position?

Legal teams obviously need FIDIC knowledge. But general contract lawyers often struggle with construction specifics. FIDIC training bridges that gap.

Consultants and advisors guide clients through projects. They need expertise to provide sound advice on contract selection and administration.

Subcontractors and suppliers work under the FIDIC main contracts. Understanding the main contract helps them understand how obligations flow down.

The benefits are substantial:

Clarity on roles and risks: You know what you’re responsible for. What the other party must do. Where risks lie. This prevents nasty surprises.

Better contract selection: You can evaluate whether the Red, Yellow, or Silver Book suits your project. You won’t blindly accept whatever the client proposes.

Improved drafting and negotiation: You know which clauses matter. Where to push back. What’s standard and what’s unusual?

Smoother administration: You follow correct procedures. You meet deadlines. You document properly. This prevents disputes.

Enhanced claims management: You know when you’re entitled to claim. How to prepare claims. How to defend against questionable claims.

Professional credibility: FIDIC knowledge is valuable. It helps in international tenders. In career advancement. In earning trust from clients and employers.

I’ve seen engineers transform after FIDIC training. They suddenly understood why certain procedures mattered. Why was documentation critical? They became more valuable to their organisations.

Common Pitfalls and Challenges Without Proper Training

Let me share what goes wrong when people use FIDIC without understanding it.

Choosing the wrong book: This is surprisingly common. A client insists on the Silver Book for a project that suits the Yellow Book better. Or vice versa. The result is constant friction because risk allocation doesn’t match project reality.

I once saw a Silver Book used for a project with extremely uncertain ground conditions. The contractor bid conservatively. The project cost far more than it should have. A Red Book would have allocated ground risk appropriately and saved money.

Misunderstanding risk allocation: People assume things without checking the contract. Contractors think the employer takes certain risks when the contract says otherwise. Employers think contractors have obligations the contract doesn’t impose.

Poor variation management: Changes happen informally. A verbal instruction here. An email agreement is there. No formal variation order. Then, at payment time, massive disputes about what was agreed.

The FIDIC variation procedure exists for good reason. Follow it.

Missing time bars: The 2017 editions have strict deadlines. You must give notice of claims within 28 days. Detailed particulars within 42 days. Miss these deadlines, and your claim might be time-barred.

Many people learn this the hard way. They have a valid claim. But they didn’t follow the notice procedure. The claim is rejected on procedural grounds.

Inadequate documentation: FIDIC requires extensive documentation. Contemporary records. Progress reports. Correspondence. Many contractors and employers keep poor records.

When disputes arise months or years later, they can’t prove their case. Memories fade. People move on. Without documentation, you lose.

Overlooking 2017 changes: Professionals familiar with 1999 editions sometimes don’t realise their project uses 2017 editions. They miss new obligations. Like enhanced health and safety duties. Or different notice procedures.

Weak contract administration: Nobody monitors deadlines. Claims aren’t processed properly. Variations pile up without resolution. Payment certificates are delayed.

Poor administration creates chaos. Small problems become big disputes.

Ignoring early warning obligations: The 2017 FIDIC contracts strengthened early warning duties. You must warn about problems early. Failure to give early warning can reduce your entitlement to time and money.

Yet many people ignore this. They don’t want to admit problems. By the time they raise issues, it’s too late.

How to Choose the Right FIDIC Training Course

Not all FIDIC training is created equal. Here’s what to look for:

Comprehensive coverage of all major books: The course should cover Red, Yellow, Silver, and ideally Gold Book. You need to understand differences and similarities.

Focus on the 2017 editions with comparison to 1999: Current practice uses 2017 editions. But many existing projects still run on 1999. You need both.

Clause-by-clause analysis. Not reading every word of every clause. But covering major provisions in detail. With explanations of what they mean in practice.

Practical case studies and exercises: Theory matters. But practical application matters more. Look for courses with real project examples. Mock exercises. Hands-on workshops.

Claims and dispute resolution emphasis: This is where money gets lost or won. The course should dedicate serious time to claims procedures, documentation, and dispute resolution.

Experienced instructors: The best trainers have actually worked on FIDIC projects. They’ve administered contracts. Handled claims. Resolved disputes. They bring real-world insight.

Academic knowledge is fine. But someone who’s been through arbitration on a FIDIC dispute teaches differently than someone who’s only read about it.

Integration of technical and commercial aspects: Especially for engineers. The training should show how technical decisions trigger contractual consequences.

Certificate or credential: While not essential, certification demonstrates you’ve completed rigorous training. It helps with career advancement and professional credibility.

Practical resources: Good courses provide tools. Templates. Checklists. Flowcharts. References. Things you can actually use back at work.

Up-to-date content: Contract practice evolves. FIDIC occasionally issues updates. The course should reflect current practice as of 2025, not outdated information.

Flexible delivery for working professionals: Many courses now offer online or modular formats. This helps if you can’t take a full week off work.

Check reviews from past participants. Ask colleagues for recommendations. A mediocre course wastes time and money. Quality training pays for itself many times over.

Why RKS Trainings is the Preferred Choice for FIDIC Contract Training in Noida & Delhi NCR

For professionals across Noida, Delhi, and the wider NCR region, RKS Trainings has become a trusted destination for mastering FIDIC contracts. With a strong reputation for delivering industry-oriented, practical training, RKS offers specialised programs on the Red, Yellow, Silver, and Gold Books—designed to meet the needs of engineers, project managers, contract administrators, and EPC professionals. Their sessions blend real project case studies, hands-on exercises, and clause-by-clause interpretation to ensure participants gain genuine working expertise. Conveniently located in Noida, with additional sessions conducted in Delhi, RKS Trainings provides both classroom and live-online formats, making it accessible for corporate teams and individuals alike. For anyone serious about working on international projects or upgrading contract management capabilities, RKS Trainings stands out as the most reliable and practical choice in the region.

To Learn about Contract Management Training for EPC & Construction Projects – Click Here

Frequently Asked Questions

What is the difference between FIDIC Red, Yellow and Silver Books, and when should each be used?

Red Book suits traditional construction where the employer designs. The Yellow Book is for design-build projects where the contractor designs. The Silver Book is for complete EPC turnkey projects with maximum contractor risk. Choose based on who should design, desired risk allocation, project complexity, and whether you want a lump-sum fixed-price approach versus a measurement-based payment.

Why was the 2017 edition of FIDIC Books released, and what major changes were introduced?

FIDIC updated contracts to reflect modern project practices and legal developments. Major changes include explicit health and safety provisions, clearer liability cap structures, strengthened early warning obligations, tighter time-bar procedures for claims, improved dispute resolution processes, and restructured contract data. The updates also addressed ambiguities from the 1999 editions that caused disputes and improved overall clarity.

Can contractors or engineers familiar with the 1999 editions transition to 2017 without training?

Technically, yes, but it’s risky. While the fundamental structure remains similar, clause numbering changed, new obligations were added, and some procedures were modified. People often think they understand based on old knowledge but miss critical differences. This leads to procedural mistakes, missed deadlines, and lost claims. Training accelerates understanding and prevents costly errors from outdated assumptions.

Is the FIDIC Gold Book commonly used? For what types of projects?

Gold Book is less common than Red, Yellow, or Silver Books. It’s designed for design-build-operate projects where the contractor builds the facility and then operates it long-term. Think public-private partnerships, toll roads, water treatment plants with operational contracts, or infrastructure projects with 20-30 year operational phases. Gold Book suits situations where long-term performance incentives matter.

Does the Silver Book put too much risk on the Contractor? When is it advisable to use it?

Silver Book heavily favours employers by loading risk onto contractors. When the scope should be well-defined, site conditions are clear, project requirements are stable, and you want fixed-price certainty with guaranteed performance. It suits experienced contractors bidding on well-understood projects. Avoid it when the scope is uncertain, site investigation is limited, or frequent changes are likely.

What happens if you choose the wrong FIDIC Book for your project?

Mismatched risk allocation causes constant friction. If you use Silver Book on uncertain projects, contractors add huge contingencies, or you face disputes over every unforeseen issue. If you use Red Book on design-build projects, you get arguments about design responsibility. Wrong book choice increases costs, delays projects, and multiplies disputes. Sometimes projects are abandoned when parties realise the contract doesn’t fit reality.

Do you need a legal background to understand FIDIC contracts, or can engineers handle it after training?

Engineers can absolutely handle FIDIC contracts with proper training. While FIDIC has legal elements, it’s fundamentally about project delivery, risk management, and administration. Many excellent contract managers come from engineering backgrounds. Legal expertise helps with disputes and complex negotiations, but day-to-day contract administration suits trained engineers and project professionals well. The key is proper education.

How do claims and dispute resolution work under FIDIC? Are there standard procedures?

FIDIC has detailed procedures. Claims require notice within 28 days of becoming aware. Detailed particulars follow within 42 days. The Engineer or Employer’s Representative makes determinations. If a party disagrees, they can refer disputes to a Dispute Avoidance Board. If still unresolved, arbitration follows. Each step has timelines and procedures. Miss deadlines and you risk losing rights.

What are common pitfalls for inexperienced users of FIDIC contracts?

Major pitfalls include choosing the wrong book, missing notice deadlines and time bars, poor documentation, weak variation management, ignoring early warning obligations, not understanding risk allocation differences between books, confusion between 1999 and 2017 editions, inadequate contract administration, and failing to follow prescribed procedures. Most problems stem from ignorance rather than malice.

Can training help in executing complex EPC, turnkey or international infrastructure projects successfully?

Absolutely. Training provides the foundation for proper contract selection, risk management, claims handling, variation control, and dispute avoidance. It helps teams understand their obligations, follow correct procedures, and maintain proper documentation. For complex international projects, FIDIC knowledge is essential. Many successful mega-projects credit proper contract management as critical to their success. Training reduces risks significantly.