Table of Contents

Why Contract Risk Matters in Projects

Every project runs on agreements. These agreements define what will be delivered, who will deliver it, how much it will cost, and what happens if something goes wrong. In other words, contracts sit at the heart of project success or failure.

When contract risks are ignored or poorly managed, projects suffer. Costs creep up quietly. Timelines slip. Disputes begin. In serious cases, projects end in litigation, damaged relationships, and financial loss. Many project failures are not caused by poor execution on-site. They start much earlier, hidden inside unclear clauses, unbalanced obligations, or unrealistic assumptions written into contracts.

Contract risk management exists to prevent this. It is not just a legal activity handled in isolation. It is a core project governance function that connects legal, commercial, procurement, and project delivery teams.

Think of a contract like the foundation of a building. If the foundation is weak, no amount of careful construction later can fully fix the problem. Contract risk management helps ensure that the foundation is solid before the project begins and remains stable throughout execution.

This guide explains contract risk management and mitigation strategies for projects in a clear, practical way. The focus is on understanding risks, managing them early, and using contracts as tools for control rather than sources of conflict.

What is Contract Risk Management?

Contract risk management is the structured process of identifying, assessing, allocating, mitigating, and monitoring risks that arise from contracts and contractual relationships. These risks can affect cost, schedule, quality, performance, and even the reputation of the organizations involved.

At its simplest level, contract risk management asks a few basic questions. What could go wrong because of this contract? Who will be responsible if it does? How can we reduce the chance of that happening? And if it does happen, how do we limit the damage?

Contract risk management applies across many types of agreements. It is used in commercial contracts, vendor and supplier agreements, EPC and construction contracts, IT and outsourcing arrangements, SaaS contracts, and public-private partnership projects. The principles remain the same, even though the details differ.

It is important to separate contract risk from other types of risk. Contract risk is not the same as project execution risk. Execution risk relates to how well the work is performed on the ground. Contract risk relates to how responsibilities, rights, and consequences are defined on paper. A team may execute work perfectly and still face losses because the contract allocated risk unfairly.

Contract risk is also different from pure legal risk. Legal risk focuses on enforceability and compliance with law. Contract risk looks broader. It includes commercial balance, operational feasibility, and alignment with project realities.

Contract Risk Management in Projects: Context and Scope

In projects, contract risks rarely sit alone. They interact closely with scope, cost, schedule, and quality management. An unclear scope clause can lead to disputes over deliverables. A poorly defined payment structure can strain cash flow. Unrealistic timelines written into contracts create pressure that no execution team can realistically meet.

This is why contract risk management must begin early. The most critical stages are the bid phase, contract negotiation, and project kickoff. Decisions made here shape risk exposure for the entire project lifecycle.

Once a project is underway, fixing contract problems becomes expensive and difficult. It is similar to discovering a design flaw after construction has started. Changes are possible, but they come at a high cost.

Early contract risk planning allows project teams to align contract terms with actual delivery capability. It ensures that risks are understood, shared appropriately, and actively managed rather than ignored.

Types of Contract Risks in Projects

Contract risks come in many forms, and understanding their nature helps in managing them effectively.

Commercial and financial risks are among the most common. These include pricing models that do not reflect actual costs, delayed payments that affect cash flow, currency fluctuations in international contracts, and cost escalation clauses that shift financial burden unfairly.

Legal and compliance risks arise when contracts fail to meet regulatory requirements or contain clauses that are difficult to enforce. Jurisdiction mismatches, unclear governing law, data protection obligations, and intellectual property ownership issues fall into this category. These risks often surface late, when disputes arise.

Scope and performance risks occur when contracts do not clearly define what is to be delivered, how performance will be measured, or when deliverables will be accepted. Ambiguous scope language is one of the biggest sources of project conflict. It leaves room for different interpretations, which almost always lead to claims.

Vendor and supplier risks relate to the parties delivering the work. These include vendor insolvency, lack of capacity, dependence on a single supplier, and uncontrolled subcontracting. Even a well-drafted contract cannot succeed if the supplier cannot perform.

Operational and force majeure risks cover events beyond direct control. Supply chain disruptions, labor shortages, natural disasters, and political changes can all affect contract performance. Contracts need mechanisms to address these realities fairly.

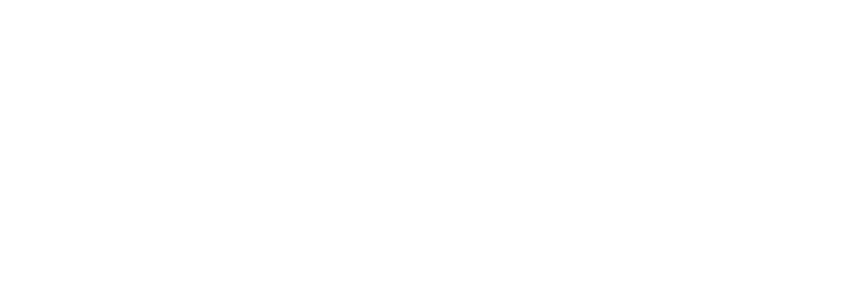

Contract Risk Assessment Process

Effective contract risk management starts with a structured assessment process. Skipping this step is like driving without checking the fuel level or tire pressure.

The first step is contract review and risk identification. This involves a detailed clause-by-clause analysis of the contract. Legal teams, procurement professionals, and project managers should work together. Each group sees different risks. Lessons learned from past projects provide valuable insight here.

Once risks are identified, they must be categorized. Financial risks, legal risks, operational risks, and reputational risks should be clearly separated. Categorization helps teams understand the nature of each risk and who is best placed to manage it.

The next step is risk analysis and prioritization. Not all risks are equal. Some are unlikely but severe. Others are frequent but manageable. Assessing both probability and impact helps focus attention where it matters most.

Finally, risk ownership must be assigned. Every contract risk should have a clear owner. This could be the client, the vendor, or a shared responsibility. Risks without owners tend to be ignored until they cause damage.

Contract Risk Mitigation Strategies

Once risks are understood, mitigation strategies come into play. There are four broad approaches to managing contract risk.

Risk avoidance involves changing the contract or scope to remove the risk entirely. This may mean redesigning deliverables, excluding high-risk clauses, or even walking away from an unbalanced contract. Sometimes the safest decision is not to sign.

Risk reduction focuses on lowering the likelihood or impact of risks. Clear scope definitions, realistic timelines, performance indicators, and milestone-based payments all help reduce uncertainty. This is the most commonly used approach in projects.

Risk transfer shifts responsibility to another party, usually through contractual clauses. Indemnities, insurance requirements, and liquidated damages are common tools. However, transferring risk does not eliminate it. If the other party cannot absorb the risk, it may return later in another form.

Risk sharing distributes risk between parties. Gain-share and pain-share mechanisms align incentives. Joint governance structures encourage collaboration. Risk sharing works best when parties trust each other and have aligned goals.

Understanding the difference between risk transfer and risk sharing is critical. Transfer pushes responsibility away. Sharing encourages cooperation.

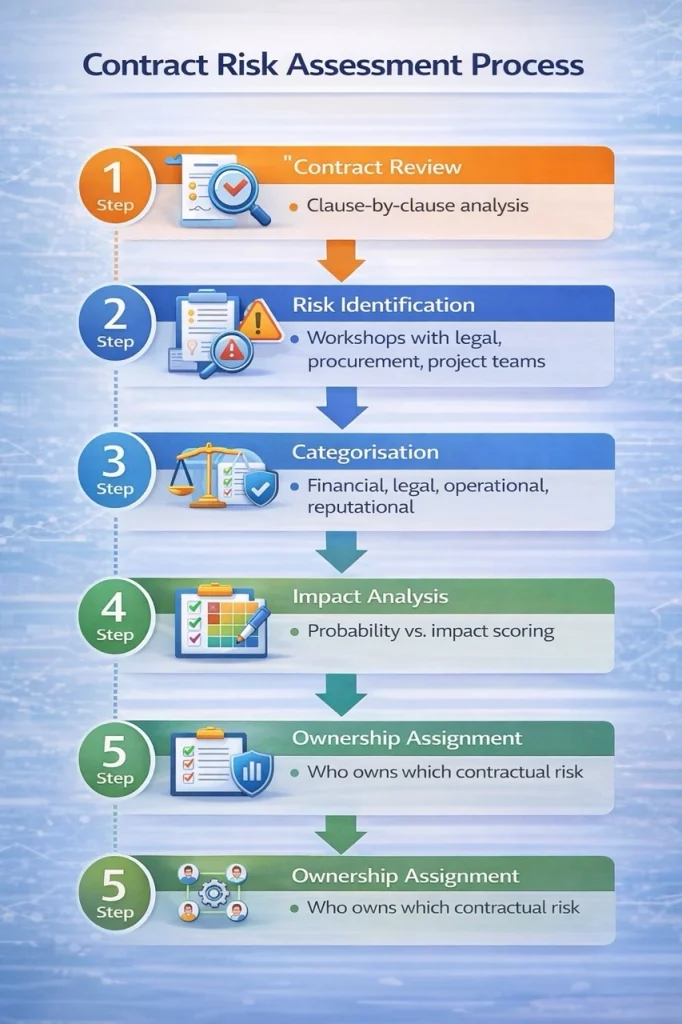

Contract Risk Mitigation Clauses: Practical Examples

Contracts use specific clauses to manage risk. Each clause addresses a particular concern.

Limitation of liability clauses cap the financial exposure of parties. They protect against catastrophic losses but must be balanced carefully to remain fair.

Indemnity clauses allocate responsibility for specific losses, such as third-party claims or regulatory fines. These clauses clarify who pays when things go wrong.

Force majeure clauses address events beyond reasonable control. They provide relief when performance becomes impossible due to natural disasters or political events.

Change management clauses define how scope changes are handled. They are essential for controlling scope creep and managing cost and schedule impacts.

Termination clauses allow parties to exit contracts under defined conditions. Termination for convenience provides flexibility, while termination for default enforces accountability.

Escalation and dispute resolution clauses guide how conflicts are resolved. Clear escalation paths help resolve issues before they turn into formal disputes.

Each clause acts like a safety mechanism. Together, they form a system of controls.

Managing Vendor and Supplier Risks Through Contracts

Vendors and suppliers are central to project success. Contracts play a key role in managing these relationships.

Due diligence requirements ensure that suppliers are financially stable and capable. Performance bonds or bank guarantees provide financial security. Controls on subcontracting prevent unauthorized delegation of work.

Audit and inspection rights allow clients to verify compliance. Exit and transition clauses ensure continuity if a vendor relationship ends.

These mechanisms help protect the project without damaging collaboration.

Contract Lifecycle Risk Management

Contract risk changes across the contract lifecycle. Before the award, risks related to unclear scope and pricing assumptions. During negotiation, unbalanced clauses pose threats. During execution, non-performance and compliance issues emerge. During change phases, scope creep becomes a concern. At close-out, disputes and claims often surface.

Managing risk at each stage requires different controls. Detailed RFPs, strong reviews, active governance, and clear completion criteria help keep risks under control throughout the lifecycle.

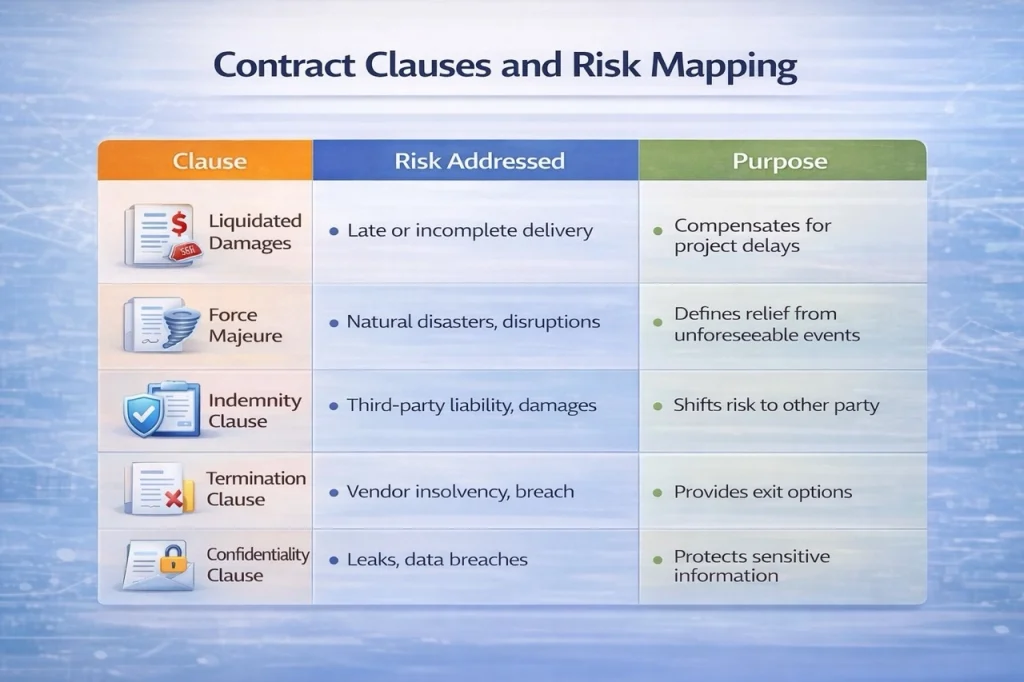

Contract Risk Register and Mitigation Plan

A contract risk register is a living document that tracks identified risks, related clauses, owners, likelihood, impact, and mitigation actions. It connects contractual risks with project risk management.

When integrated with governance dashboards, the risk register provides visibility. It helps teams act proactively rather than reactively.

Monitoring and Controlling Contract Risks During Projects

Contract risk management does not end when the contract is signed. Continuous monitoring is essential.

Regular compliance reviews, performance metrics, early warning indicators, and change order tracking help identify issues early. Claims and disputes should be tracked systematically, not handled ad hoc.

Active monitoring turns contracts into management tools rather than static documents.

Role of Contract Lifecycle Management Tools

Technology supports contract risk management through contract lifecycle management tools. These systems store contracts centrally, manage versions, provide clause libraries, and trigger alerts for key events.

Automation reduces manual errors. Visibility improves decision-making. Compliance becomes easier to enforce.

Using CLM tools is like moving from scattered paper files to a well-organized digital archive.

Common Legal and Compliance Risks in Commercial Contracts

Legal and compliance risks often hide in technical language. Regulatory non-compliance, unclear data protection obligations, ambiguous intellectual property ownership, and ethics clause violations can all create serious consequences.

Governing law mismatches create confusion during disputes. Addressing these risks early protects both parties.

Best Practices in Contract Risk Management

Strong contract risk management follows clear principles. Legal teams should be involved early. Contract strategy must align with project strategy. Standard clauses reduce inconsistency. Project managers need basic contract training. Risk registers should remain active. Data and tools should support decisions.

These practices create consistency and control.

Conclusion

Contract risk management is proactive, not reactive. It requires planning, collaboration, and continuous attention.

Strong contracts combined with active monitoring lead to fewer disputes, better cost control, and smoother project delivery. Projects that treat contracts as living risk instruments consistently perform better than those that treat them as paperwork.

Effective contract risk management turns contracts from potential liabilities into powerful project control tools.

Read : EPC Contract Management: From Tender to Closeout

Frequently Asked Questions

What is contract risk management in simple terms?

Contract risk management is the process of identifying and handling risks that come from contracts used in projects. These risks can relate to cost, timelines, responsibilities, or legal obligations. The goal is to reduce surprises by thinking ahead about what could go wrong and deciding how to deal with it before problems arise.

Why is contract risk management important for projects?

Contract risk management is important because many project problems start with unclear or poorly written contracts. If risks are not managed early, projects may face delays, cost overruns, disputes, or even legal action. Managing contract risks helps keep projects on track and protects both parties involved.

Is contract risk management only the responsibility of legal teams?

No, contract risk management is not only a legal responsibility. While legal teams handle compliance and enforceability, project managers, procurement teams, and commercial teams also play key roles. Contract risks affect delivery, cost, and timelines, so they must be managed as part of overall project governance.

How early should contract risks be identified in a project?

Contract risks should be identified as early as possible, ideally during the bid or negotiation stage. Once a contract is signed, fixing problems becomes difficult and expensive. Early identification allows teams to negotiate fair terms and align contracts with real project conditions.

What are the most common contract risks in projects?

Common contract risks include unclear scope definitions, unrealistic timelines, unbalanced payment terms, weak change management clauses, and unclear responsibility allocation. Vendor-related risks, such as lack of capacity or financial instability, are also frequent sources of contract-related issues.

How do contracts help in managing vendor and supplier risks?

Contracts help manage vendor risks by clearly defining performance expectations, timelines, penalties, and exit conditions. Clauses such as performance guarantees, audit rights, and termination provisions provide control and protection if a vendor fails to meet obligations.

What is the difference between risk transfer and risk sharing in contracts?

Risk transfer means shifting responsibility for a risk to another party, often through clauses like indemnities or insurance requirements. Risk sharing means both parties agree to bear certain risks together, usually through mechanisms like gain-share or pain-share arrangements. Risk sharing often encourages cooperation, while risk transfer focuses on protection.

Can contract risk be eliminated?

No, contract risk cannot be fully eliminated. Every project involves uncertainty. However, contract risk can be reduced and controlled through clear drafting, balanced terms, proper risk allocation, and active monitoring during project execution. The aim is to manage risk, not remove it entirely.

How is contract risk monitored during project execution?

Contract risk is monitored through regular reviews of contract compliance, tracking performance against agreed terms, managing change requests carefully, and watching for early warning signs such as delays or disputes. Maintaining a live contract risk register helps teams stay aware of emerging risks.

How does good contract risk management improve project outcomes?

Good contract risk management reduces disputes, improves cost control, and creates clarity for all parties. When responsibilities and consequences are clear, teams can focus on delivery instead of conflict. Over time, this leads to smoother projects, stronger relationships, and better overall performance.