EPC project success depends on far more than engineering skill or on-site execution. While technical excellence is essential, it does not guarantee profitability or predictability on its own. The real differentiator lies in strong commercial management, which governs how risks are allocated, costs are controlled, and value is protected throughout the project lifecycle. Effective commercial discipline ensures that contracts are clearly interpreted, variations are managed on time, claims are handled strategically, and cash flow remains stable. Without this structure, even well-executed projects can suffer margin erosion, disputes, and financial uncertainty. Leading EPC contractors understand that profit is rarely created during execution alone. It is safeguarded through early contract strategy, proactive risk management, accurate cost forecasting, and timely commercial decisions. Commercial management is not a back-office function but a leadership responsibility that directly influences project outcomes. When commercial controls are embedded into project planning and execution, EPC organizations gain better predictability, fewer disputes, and stronger financial performance. In competitive EPC environments, disciplined commercial management is the framework that converts technical delivery into sustainable profitability.

Table of Contents

Why Commercial Management is Critical in EPC

EPC projects look simple on paper. One contractor takes responsibility for engineering, procurement, and construction. One contract. One delivery promise. But anyone who has worked on an EPC project knows the reality is very different.

EPC contracts push cost, schedule, and performance risk heavily onto the contractor. Fixed prices, tight timelines, and strict performance guarantees leave very little room for error. A small miss in design assumptions. A late drawing. An unexpected ground condition. Any of these can quietly eat into margins.

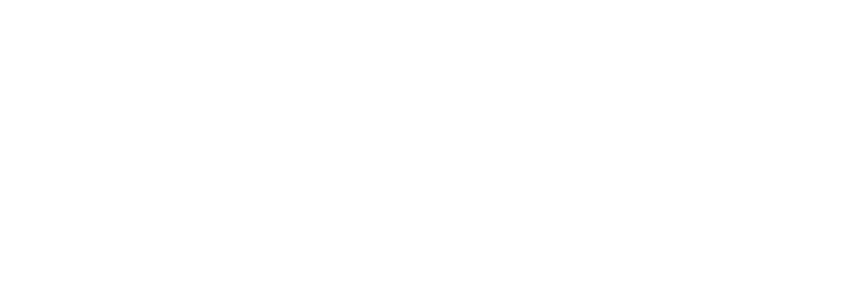

This is where commercial management in EPC contracts becomes critical. It is not a back-office activity. It is not just about claims after things go wrong. Strong commercial management works from the bid stage to the final close-out. It connects contracts, cost control, cash flow, risk, and claims into one coordinated system.

You can think of commercial management as the project’s financial nervous system. When it works well, problems are felt early and addressed. When it fails, issues surface late, often when it is too expensive to fix them.

This article explains commercial management in EPC contracts, best practices for project success. The focus is practical. Real situations. Real risks. And clear actions that protect margins and reduce disputes.

What is Commercial Management in EPC Contracts?

Commercial management in EPC contracts refers to the structured management of commercial, contractual, financial, and risk-related aspects of an EPC project across its entire lifecycle. It starts before the contract is signed and continues until the final account is closed.

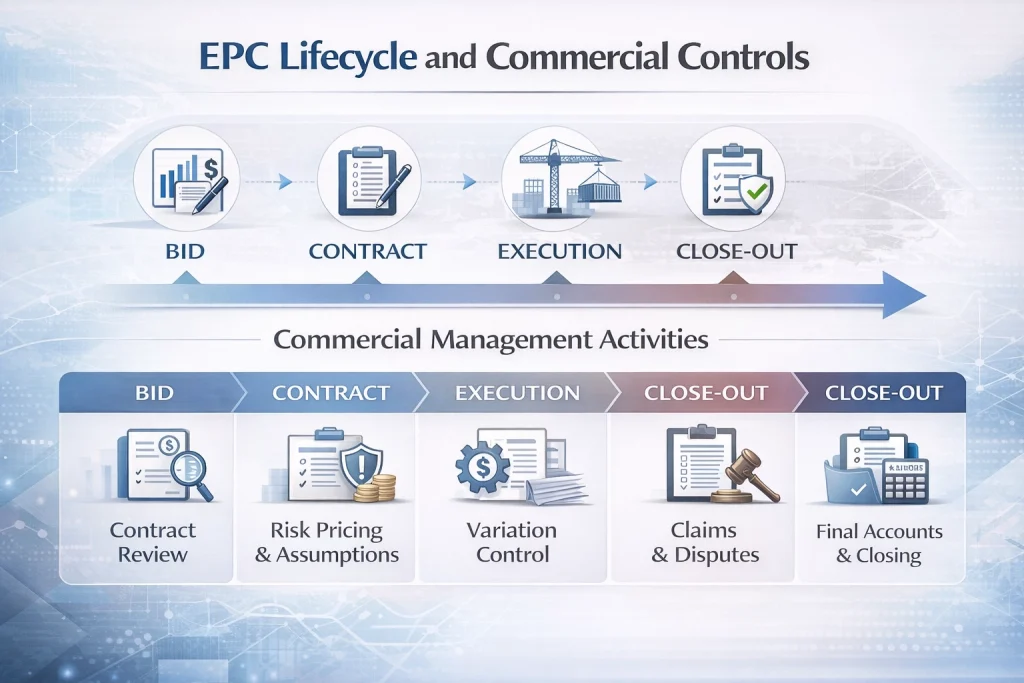

Commercial management is often confused with project management. They are related, but not the same. Project management focuses on planning, scheduling, and executing work. Commercial management focuses on protecting value. It asks questions like who pays, when they pay, what happens if something changes, and how risks are priced and controlled.

It is also different from contract administration. Contract administration focuses on following contract procedures, issuing notices, and maintaining correspondence. Commercial management uses those processes, but goes further. It looks at strategy, negotiation, claims, and long-term financial outcomes.

EPC commercial management is more complex than in traditional contracts because EPC agreements are usually turnkey and fixed-price. The contractor carries design risk, procurement risk, construction risk, and often performance risk. One weak commercial decision early can affect the project for years.

EPC Contract Commercial Management: Scope and Objectives

The scope of the EPC contract commercial management is broad. Its primary objective is margin protection. EPC margins are often thin. Even small cost overruns or unclaimed variations can wipe them out.

Another key objective is risk monetization and mitigation. Risks exist whether they are priced or not. Commercial management ensures risks are identified, priced where possible, and managed actively during execution.

Cash flow optimization is also critical. Many EPC projects are cash-negative in early stages. Poor payment terms or certification delays can create serious financial stress, even on profitable projects.

Commercial management also covers claims and change management. Variations are a normal part of EPC projects. The difference between a profitable project and a disputed one often lies in how changes are identified, documented, and agreed.

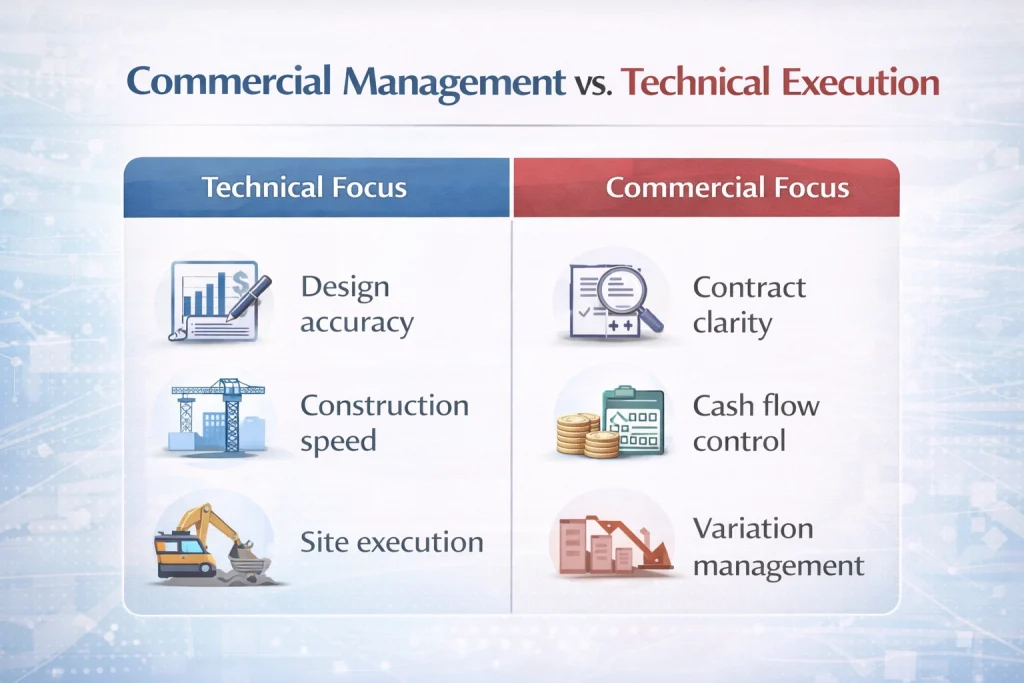

Finally, commercial management supports dispute avoidance and resolution readiness. Strong records, timely notices, and clear positions reduce disputes. If disputes do arise, the project team is prepared.

All of this supports engineering decisions, procurement strategies, construction sequencing, and project close-out. Commercial management is not separate from delivery. It is embedded within it.

Roles and Responsibilities of a Commercial Manager in EPC Contracts

The commercial manager plays a central role in EPC projects. Their responsibility is not just to react to problems, but to anticipate and control commercial outcomes.

At the core, the commercial manager interprets and administers the contract. They ensure the project team understands contractual rights and obligations. This avoids accidental waivers or missed opportunities.

Cost control and forecasting are also key responsibilities. The commercial manager tracks costs against budget, monitors trends, and forecasts the final margin. This allows management to act early if things drift.

Variation, claims, and change order management sit at the heart of the role. The commercial manager identifies change events, prepares submissions, supports negotiations, and ensures recovery where justified.

Risk identification and mitigation are continuous. Risks change as the project evolves. The commercial manager keeps the risk register live and relevant.

Cash flow and payment management are equally important. This includes managing advances, milestone certifications, retention money, and payment delays.

Subcontract commercial management is often overlooked but critical. Poorly drafted contracts can expose the main contractor to risks that cannot be recovered from subcontractors.

Throughout all this, the commercial manager works closely with legal, finance, engineering, and project teams. Commercial management does not work in isolation.

The role evolves across project stages. During bidding, the focus is on risk pricing and contract review. During negotiation, it is risk allocation. During execution, it is cost, cash flow, and claims. During close-out, it is a final settlement.

Commercial Risk Management in EPC Projects

EPC projects are risk-loaded by design. Clients transfer risk to contractors to achieve price certainty. This makes commercial risk management essential.

Common EPC commercial risks include unclear scope, late design changes, unforeseen ground conditions, delays caused by third parties, and interface risks between contractors or packages.

Commercial risk management starts with identification. Risk workshops during bidding and early execution help surface assumptions and exposures. These sessions should involve engineering, construction, procurement, and commercial teams.

Once identified, risks must be assessed. Some risks can be priced. Others cannot. Trying to price unmanageable risks often leads to inflated bids or losses later.

Contingency management is a key tool. Contingency should be treated as a controlled risk allowance, not spare money. It should be tracked, justified, and released only when risks are reduced.

Good commercial risk management accepts that not all risks can be avoided. The goal is to understand them early and manage them consciously.

Risk Allocation and Pricing in EPC Agreements

Risk allocation and pricing sit at the heart of EPC’s commercial strategy. The basic principle is simple. Risk should sit with the party best able to manage it.

Fixed-price and lump-sum turnkey contracts transfer significant risk to contractors. Reimbursable and hybrid models share risk differently, often with cost transparency but reduced price certainty.

Design liability, performance guarantees, and delay risks are major pricing drivers. If performance tests assume ideal conditions, the risk is high. If delay damages are uncapped, exposure increases sharply.

Inflation and foreign exchange risks are also critical, especially in long-duration projects. If escalation is not addressed, rising costs can destroy margins.

Best practice is to avoid accepting risks that cannot be managed or priced. Walking away from an unbalanced contract is sometimes the most commercial decision.

Contract Administration in EPC Projects

Contract administration is the backbone of commercial management. Without disciplined administration, even strong commercial positions fail.

The key elements are notices, timelines, record keeping, and correspondence discipline. EPC contracts often require strict notice periods. Missing them can mean losing entitlement.

Notices of delay, variation, or force majeure must be timely and accurate. Late or vague notices create waiver risks. Consistent templates and training help avoid mistakes.

Records are equally important. Daily reports, progress logs, meeting minutes, and correspondence create the evidence base for claims and negotiations.

Contract administration is not about being aggressive. It is about being clear, consistent, and compliant.

Cost Control and Cash Flow Management in EPC Contracts

Cost control in EPC projects requires structure and discipline. Cost breakdown structures help track spending at the right level of detail. Earned value analysis compares progress against cost and schedule.

Forecasting is more important than historical reporting. Knowing where the project will end is more valuable than knowing where it has been.

Scope creep is a silent cost killer. Small changes accumulate quickly. Commercial teams must work closely with engineering and construction to identify scope growth early.

Cash flow management is equally critical. EPC projects often require large upfront expenditure. Advance payments help, but recovery mechanisms can create cash strain later.

Milestone-based payments must align with actual progress. Certification delays should be flagged early. Retention money impacts cash flow long after work is complete.

Managing negative cash flow periods is part of commercial planning, not an afterthought.

Managing Claims, Variations, and Change Orders

Claims, variations, and change orders are often misunderstood. A variation is a change to the scope. A claim is a request for time or money due to a contractual event. A change order is the agreed outcome.

Common claim triggers include late drawings, employer changes, differing site conditions, and delays beyond the contractor’s control.

Best practice is early identification. Waiting until the end of the project weakens positions. Contemporary records support cause-and-effect linkage.

Quantum substantiation matters. Claims must be supported with a clear cost and time impact analysis. Strong claims focus on facts, not emotions.

Negotiation should be the first goal. Escalation is costly and damages relationships.

Performance Guarantees and Liquidated Damages

Performance guarantees are common in EPC contracts. They may relate to output, efficiency, or availability. These guarantees must align with design assumptions and operating conditions.

Liquidated damages apply for delay or underperformance. While LDs provide certainty, they can be punitive if not capped.

Best practice includes negotiating realistic testing conditions, setting reasonable LD caps, and avoiding double LD exposure for the same event.

Guarantees should motivate performance, not create impossible targets.

KPIs and Reporting for Commercial Performance in EPC

Commercial KPIs help teams understand project health. Margin at completion shows profitability trends. The claim recovery ratio indicates the effectiveness of change management.

Cost variance highlights overruns early. Cash flow forecast accuracy shows planning maturity.

Dashboards and regular reporting cycles help management act early. Early warning indicators are more valuable than post-facto reports.

Integrating Commercial, Legal, and Technical Teams

Many EPC disputes arise from silos. Engineering makes technical decisions without commercial input. Commercial teams react too late. Legal teams are called only when disputes escalate.

Best practice is integration. Cross-functional governance ensures that design changes, claims strategies, and risk acceptance decisions are made jointly.

Integration reduces surprises and improves decision quality.

Common Commercial Pitfalls in EPC Contracts

Common pitfalls include underpricing risks at the bid stage, poor notice management, weak subcontract flow-down clauses, and late claim submission.

Ignoring early cash flow warnings is another frequent mistake. These issues are preventable with discipline and awareness.

Commercial Lessons Learned from EPC Disputes

Most EPC disputes trace back to unclear contracts, poor records, and misaligned risk assumptions. Documentation gaps weaken positions. Lack of early engagement escalates conflicts.

Dispute avoidance mechanisms, such as escalation clauses and joint review boards, help resolve issues early.

Learning from disputes improves future projects.

Best Practices Checklist for EPC Commercial Management

Strong EPC commercial management starts early and stays active. Early involvement in bids, clear risk pricing, disciplined contract administration, strong records, proactive claims management, integrated reporting, and continuous learning form the foundation.

These practices do not eliminate risk, but they control it.

Conclusion

EPC success is not driven by technical excellence alone. It is equally shaped by commercial discipline.

Strong commercial management protects margins, improves cash flow, reduces disputes, and increases predictability. Leading EPC contractors treat commercial management as a core leadership function, not a support role.

In EPC contracts, profit is not made in execution alone. It is protected through disciplined commercial management.

Frequently Asked Questions

What is commercial management in EPC contracts in simple terms?

Commercial management in EPC contracts is the process of controlling costs, risks, payments, and contractual obligations throughout an EPC project. It ensures that the contractor gets paid correctly, manages changes properly, and protects project margins from bid stage to final close-out.

Why is commercial management so important in EPC projects?

Commercial management is important because EPC contracts place most risks on the contractor. Without strong commercial control, even well-executed projects can lose money. Effective commercial management helps manage risks, control cash flow, and avoid disputes that can damage profitability.

How is commercial management different from project management in EPC?

Project management focuses on planning and delivering work on time and within scope. Commercial management focuses on protecting financial outcomes, managing contracts, claims, and payments. Both roles must work together, but they address different aspects of project success.

When should commercial teams get involved in an EPC project?

Commercial teams should be involved from the very beginning, especially during the bid and tender stage. Early involvement helps identify risks, price them correctly, and negotiate balanced contract terms. Joining late makes it harder to recover costs or manage risks effectively.

Who owns claims and variations in EPC contracts?

Claims and variations are typically managed by the commercial team, with support from project managers, engineers, and legal advisors. While the commercial team leads the process, successful claim management depends on timely information from the entire project team.

How does commercial management help control EPC project costs?

Commercial management helps control costs by tracking budgets, monitoring trends, and identifying deviations early. It also ensures that scope changes are properly recorded and compensated. This prevents small cost increases from turning into major losses.

What are the most common commercial risks in EPC contracts?

Common commercial risks include unclear scope, design changes, delays caused by others, cash flow delays, and weak subcontract terms. These risks often appear early and grow over time if not managed actively through commercial controls.

How does commercial management support cash flow in EPC projects?

Commercial management supports cash flow by negotiating fair payment terms, managing advances and retentions, tracking certifications, and following up on delayed payments. Good cash flow management keeps the project financially healthy even during high-spend phases.

Can good commercial management reduce disputes in EPC projects?

Yes, strong commercial management significantly reduces disputes. Clear contracts, timely notices, proper documentation, and early negotiations help resolve issues before they escalate into formal disputes or arbitration.

Is commercial management only needed for large EPC contractors?

No, commercial management is important for EPC projects of all sizes. Smaller contractors often face greater financial risk because they have less buffer for losses. Structured commercial management helps protect margins regardless of project scale.